Chinabank START

Open an account online and jumpstart your financial goals faster, safer and easier!

- Open an account with just the Chinabank START App, wherever you are

- Open an account with just one government-issued ID

- Access and manage your newly opened account via Chinabank Mobile App

- Opened deposit account requires immediate funding. Please maintain an Average Daily Balance (ADB) of at least P2,000 per month from the time the account was opened.

- A service fee of P300 will be charged to your account if your balance is below the minimum monthly Average Daily Balance (ADB) for two (2) consecutive months starting from the date your account was opened.

Choose how you want to save

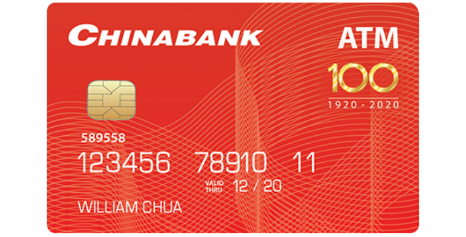

Chinabank ATM Peso Savings Account

Maintaining Balance: P2,000

Min. Balance to Earn Interest: P10,000

Interest Rate: 0.125% per annum, subject to 20% withholding tax

OKS Peso Savings

Maintaining Balance: Waived

Min. Balance to Earn Interest: P1,000

Interest Rate: 0.125% per annum, subject to 20% withholding tax

Who can open an account

- Filipino Citizens

- At least 18 years old

- Without existing Chinabank Account

- Have a permanent Philippine address

- Have an active mobile number and e-mail

To open an OKS Savings Account, you must be an OFW or a beneficiary of an OFW.