Board Policies

Board Diversity Policy

The Board should be composed of directors with a collective working knowledge, experience or expertise that is relevant to the Bank’s industry/sector. The Board should always ensure that it has an appropriate mix of competence and expertise and that its members remain qualified for their positions individually and collectively, to enable it to fulfil its roles and responsibilities and respond to the needs of the organization based on the evolving business environment and strategic direction.

To ensure diversity, the Board shall consider educational background, business experience in banking or related industry, competence, knowledge, skills and to include ethnicity, culture, skills as the case may be.

To the extent practicable, the members of the board of directors shall be selected from a broad pool of qualified candidates. A sufficient number of qualified non-executive members if not a majority of non-executive directors shall be elected to promote and help secure the objective independence of the board from the views of senior management in judgment of corporate affairs and to substantiate proper checks and balances.

The membership of the Board may be a combination of executive and non-executive directors (which include independent directors) in order that no director or small group of directors can dominate the decision making process.

The non-executive directors should possess such qualifications and stature that would enable them to effectively participate in the deliberations of the Board.

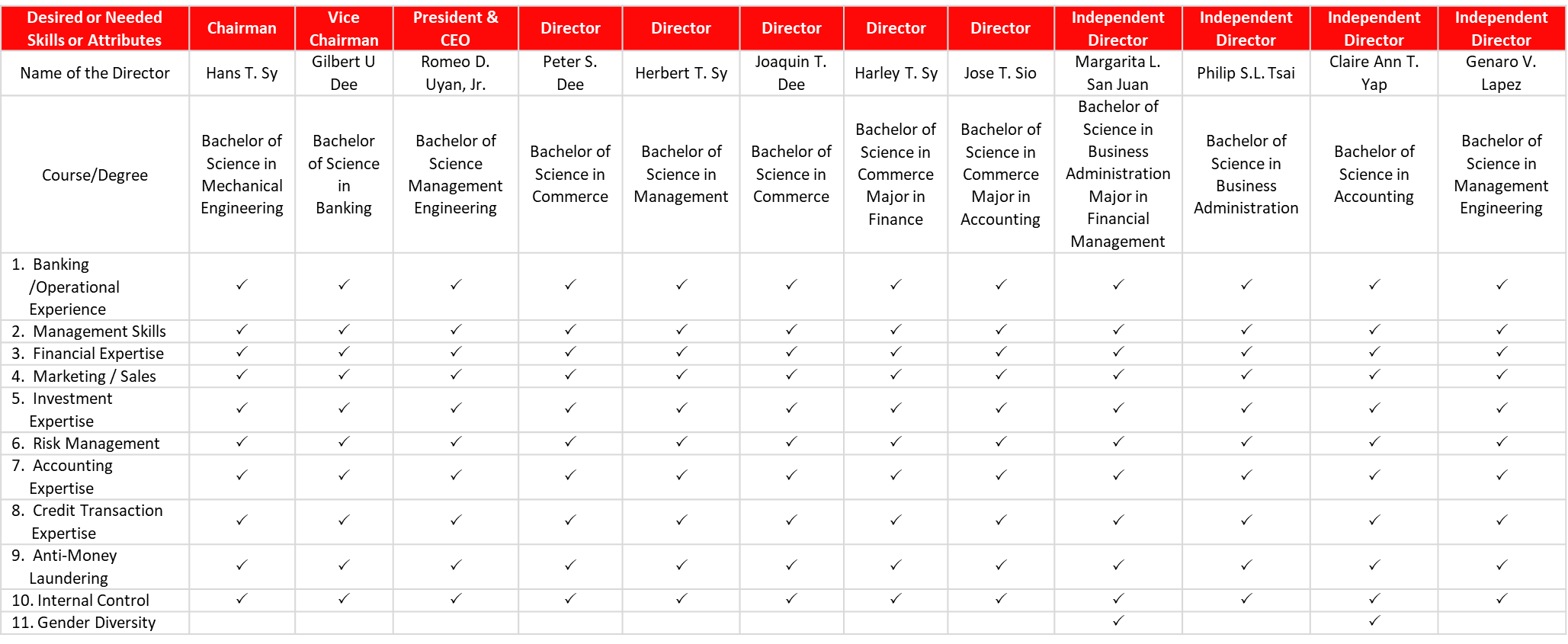

Board Skill Set Matrix and Measurable Objectives

The Board in ensuring diversity has identified the required skills and mix of qualifications of directors. Each nominee’s qualification is reviewed by the Nominations Committee in accordance with its Charter.

Below are the diversity objectives of the Board to ensure optimal mix.

- At least one (1) female Independent Director

- At least fifty percent (50%) of the members of the Board are with background or experience in Banking or Finance

- At least fifty percent (50%) of the member of the Board are with background or experience in Management and/or Business Administration

- At least fifty percent (50%) are with sufficient background or training in Anti-Money Laundering and Credit Transactions

On 01 October 2020 Special Stockholders' Meeting of the Bank, the Stockholders have elected another female Independent Director. There are now two (2) female IDs in the Board.

The Board members are all skilled and experienced. They have a collective working knowledge in banking/operations, management, finance, marketing/sales, investment, risk management, accounting, credit, anti-money laundering, internal control and sustainability & resiliency.

The table below summarizes the required skills and attributes in compliance with the diversity objectives.

Skill Set Matrix of the Directors

Independent Directors and Lead Independent Director

A strong element of independence is maintained on the Board. In fact, we conduct an annual review of the independence of our Directors. We define an Independent Director as someone holding no interests or relationships with Chinabank, the controlling shareholders, or the Management that would influence their decisions or interfere with their exercise of independent judgment, among others.

The present Board has four (4) Independent Directors (ID) and we have fully complied with all the applicable rules on their nomination and election. As stated in our Corporate Governance Manual, the tenure of an ID should not exceed a cumulative term of nine years. Chinabank is one of the first listed companies to shorten the term up to nine years. While they are in the Chinabank Board, they are not allowed to hold interlocking directorships in more than five listed companies.

On its 06 May 2021 meeting, the Board has appointed Ms. Margarita L. San Juan as the new Lead ID to replace Mr. Alfredo S. Yao, who retired after 17 faithful years of service in Chinabank's Board. She was re-appointed as the Lead ID during the Organizational Board Meeting held last 24 April 2025.

The lead Independent Director shall have sufficient authority to lead the Board in cases where management has clear conflict of interest.

Functions of the Lead Director

- Serves as an intermediary between the Chairman and the other directors when necessary;

- Convenes and chairs meeting of the non-executive directors; and

- Contributes to the performance evaluation of the Chairman, as required.

Retirement Policy for Directors

- Introduction and Objective

The Board is responsible for ensuring and adopting an effective succession planning program for directors, key officers and management to ensure growth and a continued increase in the shareholders’ value. This includes adopting a policy on the retirement age for directors and key officers as part of management succession and to promote dynamism in the corporation.(1)

The Bangko Sentral ng Pilipinas (BSP) believes that adoption of a policy on retirement for directors and officers, as part of the succession plan, will aid to promote dynamism and avoid perpetuation in power. (2)

This policy is guided by the principle that on a bigger perspective, the Bank is able to reinvigorate the composition of the Board and provide it with members who collectively possess vitally needed skills set, leadership qualities, integrity & experience to help the Bank achieve its strategic goals.

- Retirement Policy

As a matter of policy, a director shall remain in the Board of the Bank for as long he/she remains to be fit and proper(3) for the position of a director, in accordance with the requirements of the Manual of Regulations for Banks (MORB)(4).

The director shall continue to be mentally and physically fit to discharge his duties and responsibilities, which includes, physical attendance and active participation in the Board/Board Committee meetings by being able to contribute in a meaningful way through inputs and insights during the discussions(5). The director shall also ensure that he/she regularly attends the Board meetings, as set forth in the Bank’s Corporate Governance Manual and the rules of BSP.

The director has the burden to prove that he/she possesses continuing fitness or qualification for the position. The annual self-assessment process is one of the means by which a director can assess his fitness to discharge his responsibilities.

If the director no longer has the required fitness, he/she shall inform the Board of his intention to retire or refrain from seeking re-election. The Corporate Governance Committee shall take cognizance of the director's decision to retire, and take appropriate steps to ensure a smooth transition of the change in board composition.

(1) SEC Memo No. 19 (Series of 2016), Code of CG for PLCs, Recommendation 2.4 (page 11)

(2) BSP Circular No. 969 (Series of 2017), Enhanced Corporate Governance Guidelines for BSP-Supervised Financial Institutions, Section X143.1.d (3), (page 14).

(3) whether a person is fit and proper for the position of a director, the following matters must be considered: integrity/probity, physical/mental fitness; relevant education/ financial literacy/training; possession of competencies relevant to the job, such as knowledge and experience, skills, diligence and independence of mind; and sufficiency of time to fully carry out responsibilities.

(4) MORB, Section 132, Qualifications of a director

(5) Under the Bank’s CG Manual on teleconferencing and video conferencing, should attend at least fifty percent (50%) and shall physically attend at least twenty five percent (25%) of all Board meetings every year