Board Matters

References:

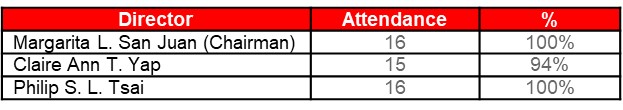

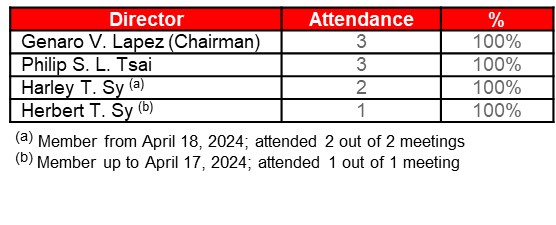

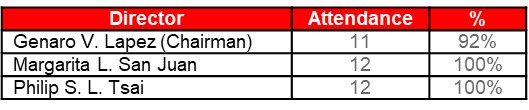

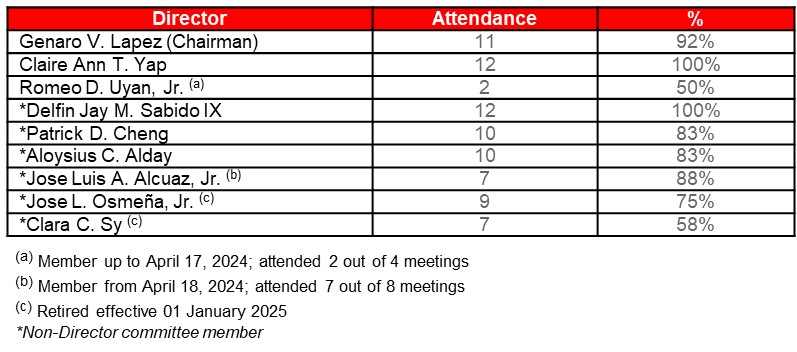

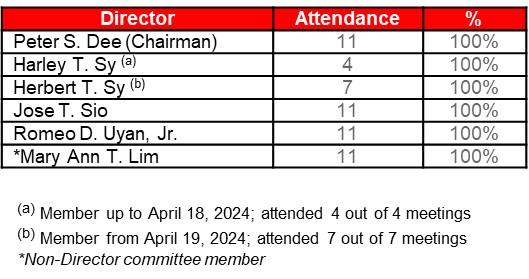

To assist in the execution of its responsibilities, the Board has established several committees. Members of the different committees are appointed by the Board during the annual organizational meeting, taking into account the optimal mix of skills and experience of the members. To promote objectivity, independent directors and non-executive directors are appointed to the greatest extent possible without impairing the collective skills, experience, and effectiveness of the committees. Each of the committees has a charter, and the members perform their duties and conduct meetings in accordance with their respective charters.

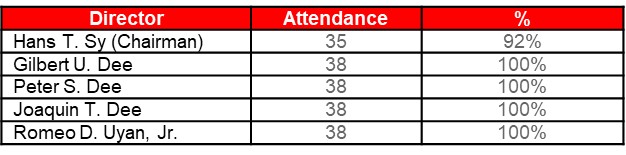

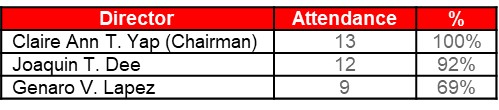

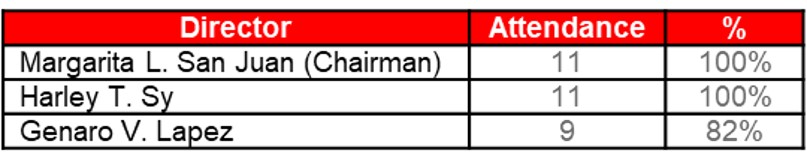

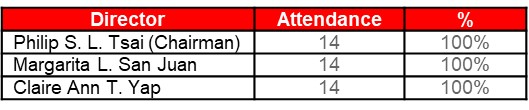

For the period January to December 2024, the Board had 19 meetings, including the organizational meeting. The incumbent directors attended at least 89% of all the Board meetings, as follows:

Board Attendance