Our Centennial Story

Chinabank celebrated 100 years of strength and resilience in 2020, a milestone that few companies reach. We are proud to have stood the test of time, grateful for the trust and support that have kept us going, and confident in the future as we continue on our journey to the next century.

One hundred years ago, Chinabank began with a handful of employees and a big dream of making a difference in people’s lives. As our story unfolded, we have done that and more—Chinabank has become a pillar of society, a driver of economic development, and a champion of corporate governance and sustainability. Over the span of a century, we have built enduring relationships of trust; for while we continue to evolve with the times, we remain true to our deeply rooted values: integrity, concern for people, high performance standards, customer service focus, commitment to quality, resourcefulness/initiative, and efficiency.

As a new chapter begins, Chinabank celebrates the past and embraces the future. We remain strongly committed to supporting stakeholders through periods of progress and volatility, and to becoming more responsive and relevant to the new generation and in the next 100 years.

TIMES CHANGE, BUT VALUES REMAIN

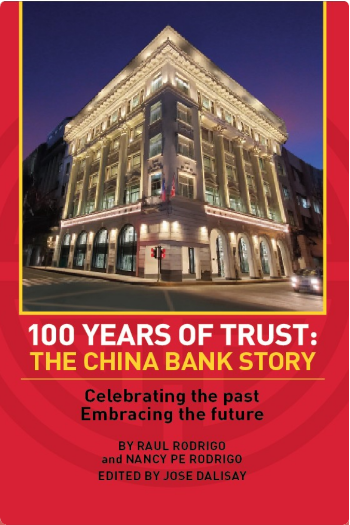

This centennial edition is an expansive update of the earlier book published for Chinabank’s 90th anniversary, and part of a bigger package to celebrate the Bank’s 100th anniversary.

An informative and engaging retelling of Chinabank’s rich history, 100 Years of Trust: The Chinabank Story, chronicles how the Bank has grown and lived up to its mission as a catalyst of wealth and value creation through the good times, and especially during difficult times, and how it continues to fulfill its responsibilities to society and country.

For easier viewing or download, the book is broken into three parts. Please click on the links below.

Download eBook: Cover to Chapter Six

Download eBook: Chapter 7 to Clients

Download eBook: Restoration - Index