Chinabank net income climbs to P10.8B in the first half of 2023

- Double digit ROE at 15.9% and ROA at 1.6%

- Robust core business and maintained good asset quality ratios: Gross NPL ratio of 2.2% was lower versus industry, while NPL cover remained adequate

- Cost-to-income ratio remained healthy at 50% despite higher investments in technology and manpower development

- Book value per share (BVS) grew 9% to P51.48

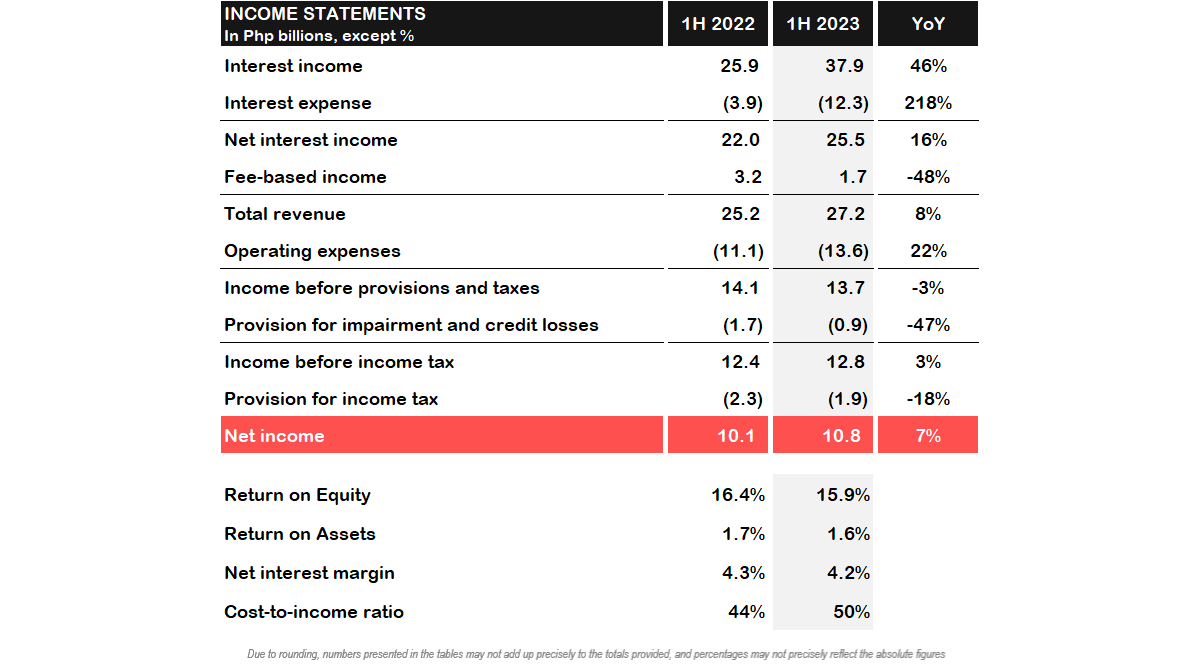

China Banking Corporation (Chinabank, PSE stock symbol: CHIB) sustained its profitability in the first half of the year on higher revenues and lower provisioning. Net profits from January to June 2023 reached P10.8 billion, up 7% from the same period last year, translating to a return on equity of 15.9% and a return on assets of 1.6%.

Quarter on quarter, net income increased by 16% to P5.8 billion in 2Q 2023 from P5.0 billion in 1Q 2023.

Total revenues hit P27.2 billion in the first semester, up 8% year-on-year. Net interest income climbed 16% to P25.5 billion as the robust growth in top line revenues offset the surge in interest expense.

“Our customer focus and disciplined operational execution enabled us to continue to deliver strong results to all our stakeholders,” said Chinabank President & CEO Romeo D. Uyan, Jr.

Chinabank booked P878 million in provisions for loan losses, lower by 47% from the same period last year, as the economy continues to recover. Non-performing loan (NPL) cover remained sufficient and above industry at 122%.

Continued heavy investments on human resource development and digital innovation, along with higher volume and revenue-related taxes, led to a 22% increase in operating expenses to P13.6 billion. Nevertheless, cost-to-income ratio remained healthy at 50%.

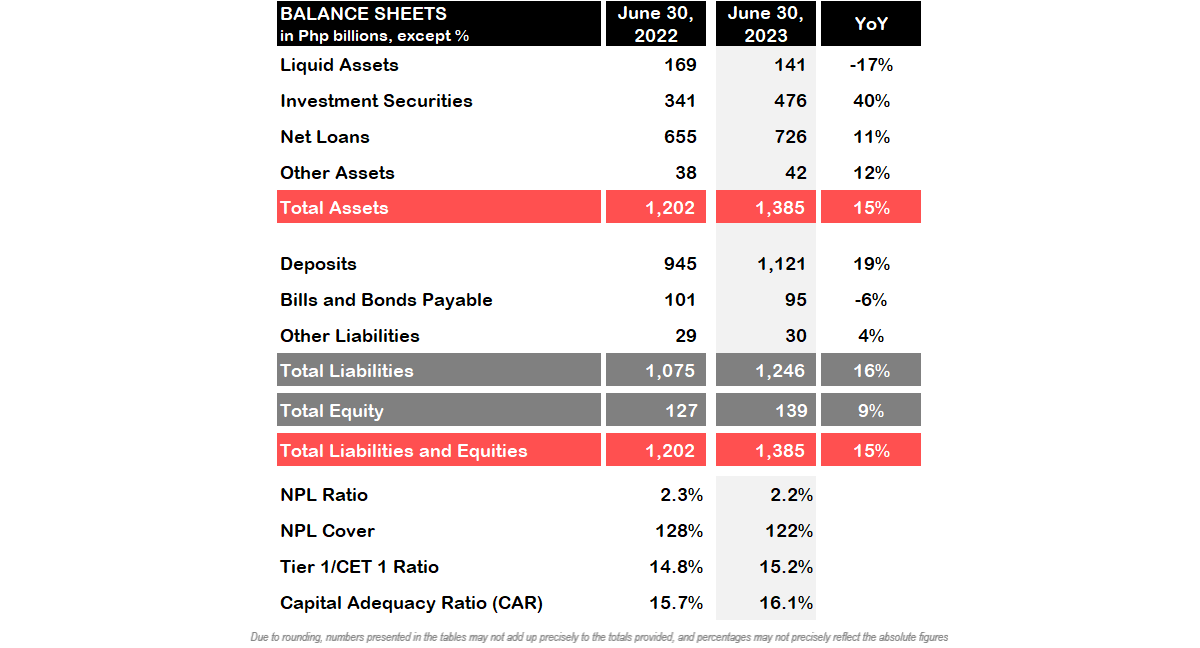

“Our balance sheet is in great shape, with an improved liquidity ratio of 45%,” said Chinabank CFO Patrick D. Cheng. “The strength of our balance sheet means we are well placed to take advantage of the growth opportunities, deliver sustainable returns to our shareholders, and more importantly, continue supporting our customers and the broader economy.”

Total assets stood at P1.4 trillion, up 15% and still the fourth largest among private domestic banks.

Net loans rose by 11% to P726 billion on stronger demand from the consumer sector, up 20%, and the business sector, up 8%. Despite the solid loans growth, asset quality remained stable, with NPL ratio easing to 2.2%, which was lower than the latest industry average.

Total deposits grew by 19% to P1.1 trillion. CASA ratio dropped to 49% due to the growth in term deposits year-on-year.

Total capital reached P139 billion, up 9%, with Common Equity Tier 1 Ratio and Total Capital Adequacy Ratio of 15.2% and 16.1%, respectively, both above the minimum regulatory requirement. Book value per share grew 9% to P51.48.

Moody's recently affirmed Chinabank's investment grade credit rating with a stable outlook. In its July 28, 2023 report, the international credit watchdog noted: "The Baa2 deposit and issuer ratings are driven by the bank's strong capitalization and profitability; as well as its modest deposit franchise, offset by its strong level of liquidity. The ratings also factor in a one-notch uplift to its baa3 Baseline Credit Assessment (BCA) to reflect the moderate probability of support from the Government of Philippines (Baa2 stable)."

Chinabank is celebrating its 103rd anniversary on August 16, 2023. It recently launched Digital Payments to make it easier for Chinabank Mobile users to pay for online purchases and bills straight from their account. It was also recently recognized among the most innovative banks in the world at the Infosys Finacle Innovation Awards 2023. Its Automatic Debit Arrangement and Direct Debit Arrangement cash management solutions won the Gold Award in the Product Innovation category.