Chinabank nets P14.7B in 9 months, up 31%

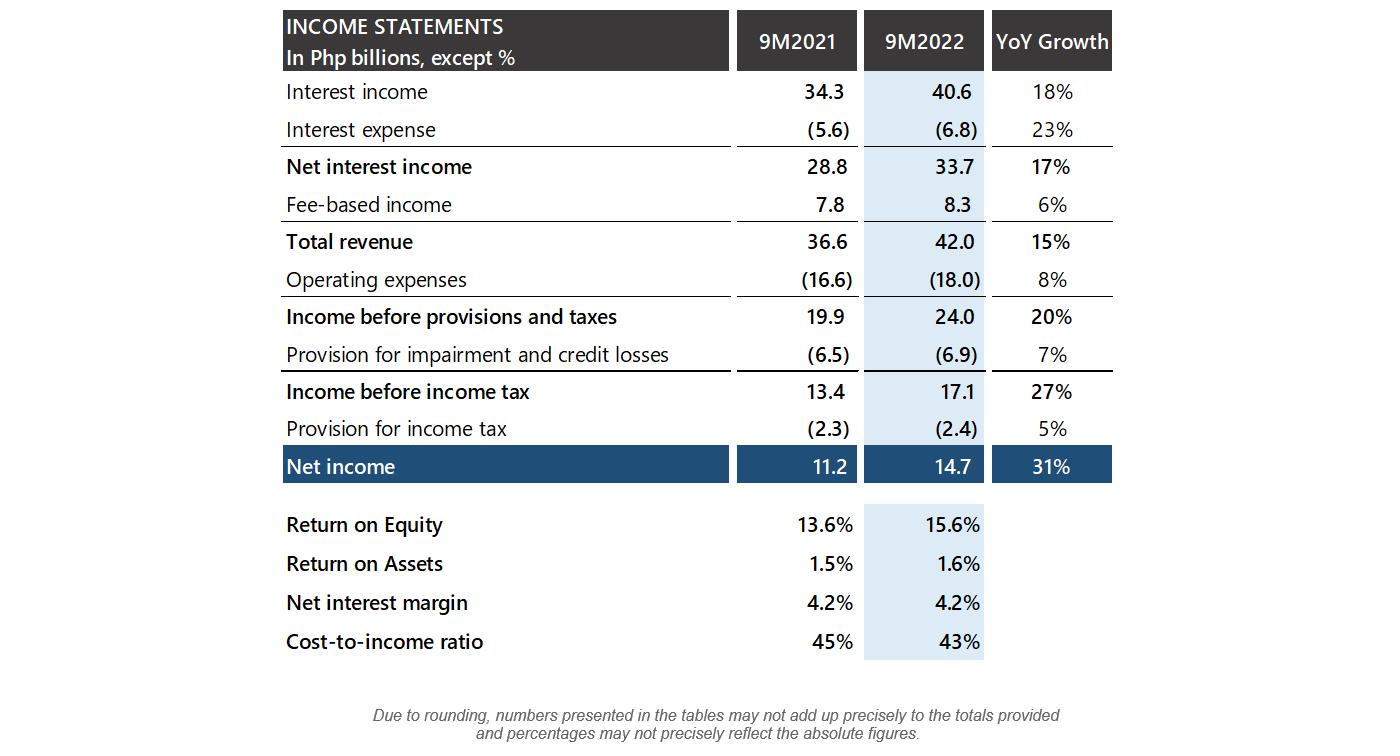

China Banking Corporation (Chinabank, PSE stock symbol: CHIB) reported a net income of P14.7 billion in the first nine months of 2022, up 31% year-on-year, on higher top line revenues and core fee income. This translated to an improved return on equity and return on assets of 15.6% and 1.6%, respectively.

Net interest income rose 17% to P33.7 billion from higher volume of earning assets, offsetting the higher interest expense amid a rising interest rate environment. Net interest margin was maintained at 4.2%.

Fee-based income grew 6% to P8.3 billion supported by the continued recovery in core revenue streams, including service charges, fees and commissions, income from the sale of acquired assets, and bancassurance.

Operating expenses increased by 8% partly due to persistent inflation and a weakening peso which further pushed up transaction-related costs and technology spend. Nevertheless, Chinabank improved its efficiency with a cost-to-income ratio of 43%.

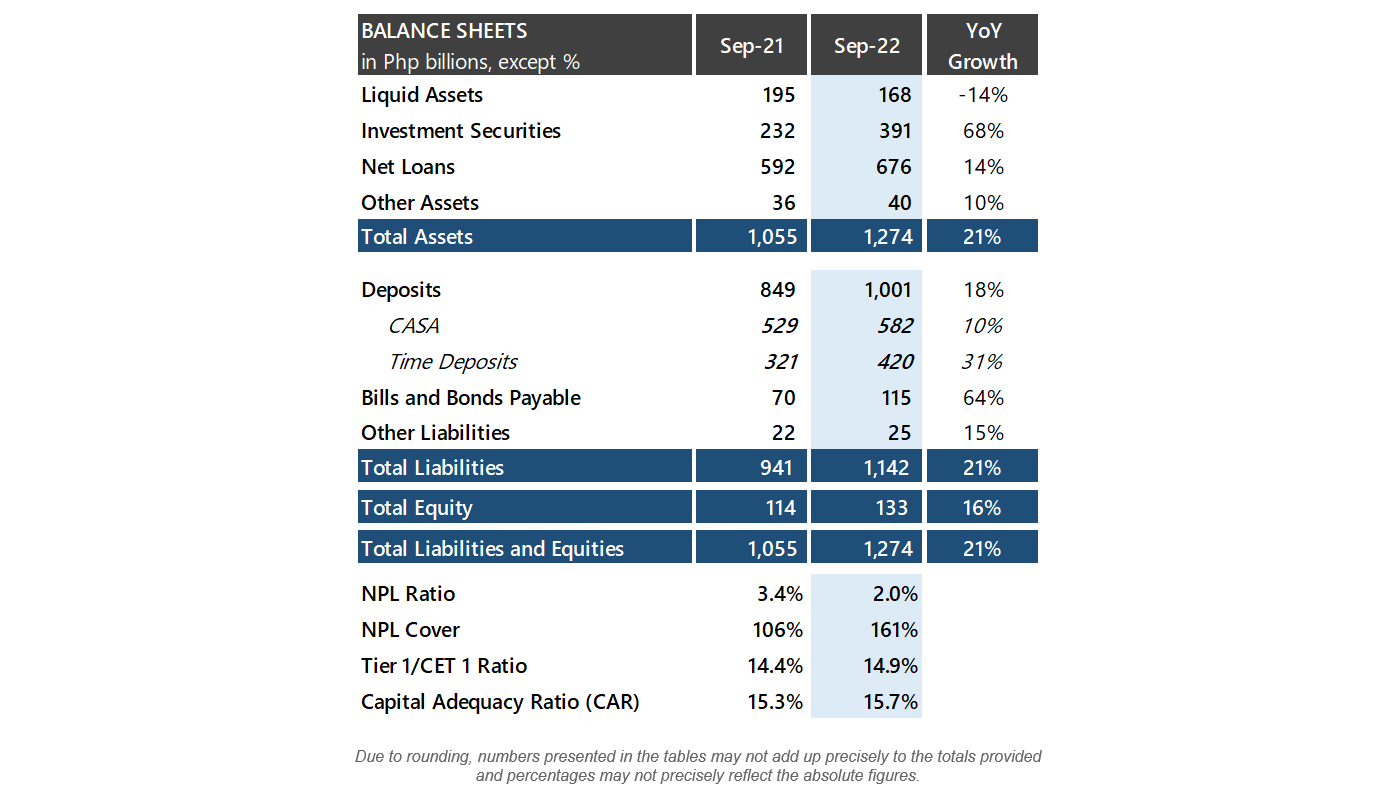

Even as gross non-performing loans (NPL) ratio eased to 2% from 3.4%, Chinabank hiked its credit provisions by 7% to P6.9 billion for an NPL coverage of 161%, well above the industry average.

Total assets reached P1.3 trillion, up 21%, on the back of continuous build-up in earning assets.

Stronger demand for corporate and consumer loans led to a 14% increase in gross loans to P697 billion.

"While there is continuous demand for loans, growth for the 3rd quarter has been more measured in the light of current macroeconomic conditions," said Chinabank Chief Finance Officer Patrick D. Cheng.

On the funding side, deposits breached the trillion-mark, increasing by 18%, driven by sustained CASA (current and savings accounts) growth of 10%.

Total capital funds expanded 16% to P133 billion, for a common equity tier 1 (CET1) ratio of 14.9% and a total capital adequacy ratio (CAR) of 15.7%.

“This performance demonstrates our strong business franchise and focused growth strategy. We will continue to efficiently use our resources to fuel the Bank's growth, support our customers, and further drive economic recovery,” said Chinabank President William C. Whang.

Chinabank was recently recognized by the Chartered Financial Analyst (CFA) Society of the Philippines for providing the best risk-based returns on a consistent basis over a five-year period. Chinabank Dollar Fund, for the sixth time since 2016, and Chinabank Intermediate Fixed-Income Fund, for the first time, won CFA’s Best Managed Fund of the Year awards in their respective categories.

Meanwhile, Chinabank Easy Tax Filing and Payment Solution (Easy Tax) won as the Best RegTech Solution at the Pay360 Awards of UK-based The Payment Association, the largest community in payments. Easy Tax, the first and only automated collection facility in the country specifically for real estate developers, was also recognized by Hong Kong-based magazine Asian Banking and Finance as the Best Digital Business Banking Initiative for Corporate Customers, along with Chinabank Direct Debit Arrangement.