Chinabank 2022 net income up 27% to P19.1 billion

China Banking Corporation (Chinabank, PSE symbol: CHIB) posted better-than-expected financial results in 2022 on the back of robust operating income and effective cost management.

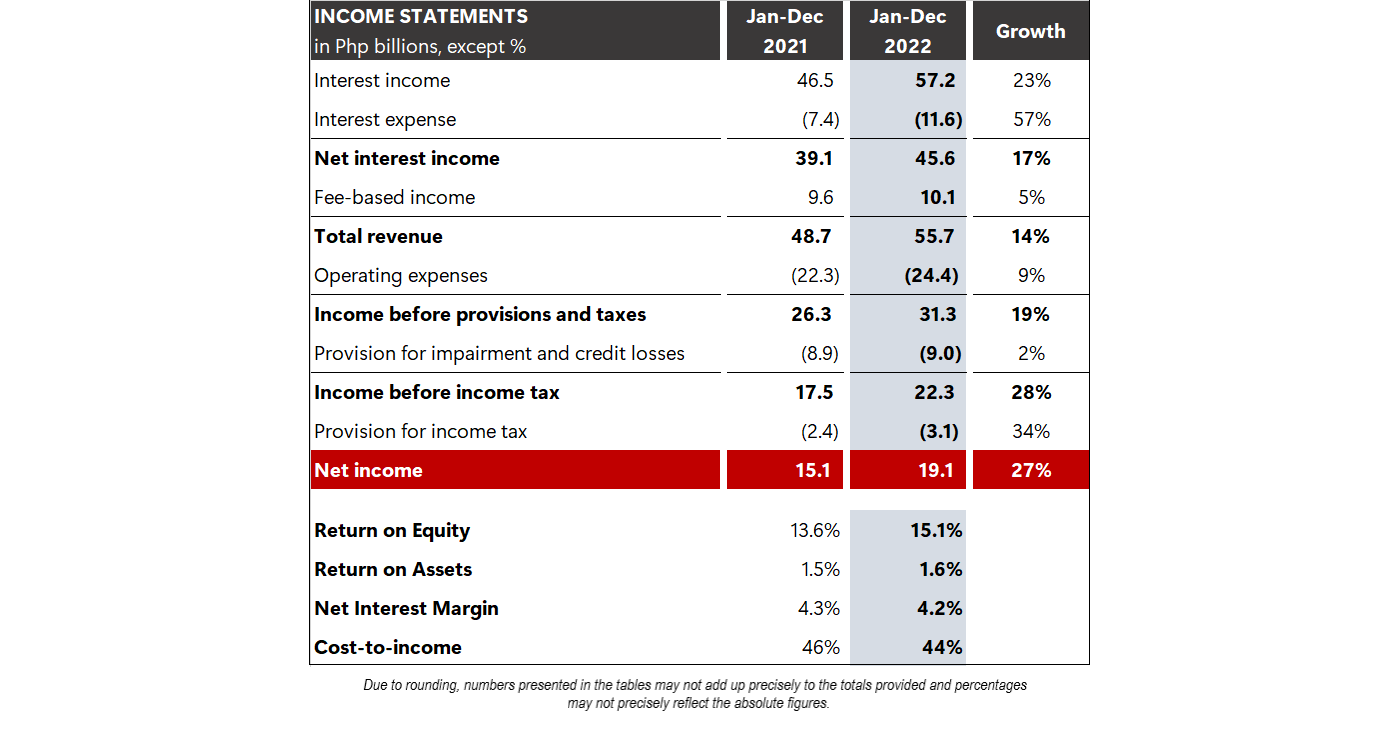

Consolidated net income grew by 27% year-on-year to P19.1 billion, which translated to a higher Return on Equity of 15.1% and Return on Assets of 1.6%.

“Our sustained strong performance amid macroeconomic headwinds is a testament to our unwavering customer focus, effective management of assets, and good cost control,” said Chinabank President William C. Whang.

Total revenues increased by 14% to P55.7 billion, driven by the 17% jump in net interest income to P45.6 billion. Interest income grew by 23% to P57.2 billion due to the continuous build-up in earning assets. Despite the 57% growth in interest expenses, the Bank’s net interest margin remained healthy at 4.2%. Meanwhile, fee-based income grew by 5% to P10.1 billion due to notable improvements in core fee income, including deposit-related transaction fees, trust revenues, bancassurance revenues, and fees from our investment banking, stock brokerage, and insurance brokerage businesses.

Operating expenses increased by 9% to P24.4 billion from bigger revenue-related taxes due to business growth and higher core operating expenses due to inflationary pressures. Nonetheless, the Bank’s cost-to-income ratio improved to 44%.

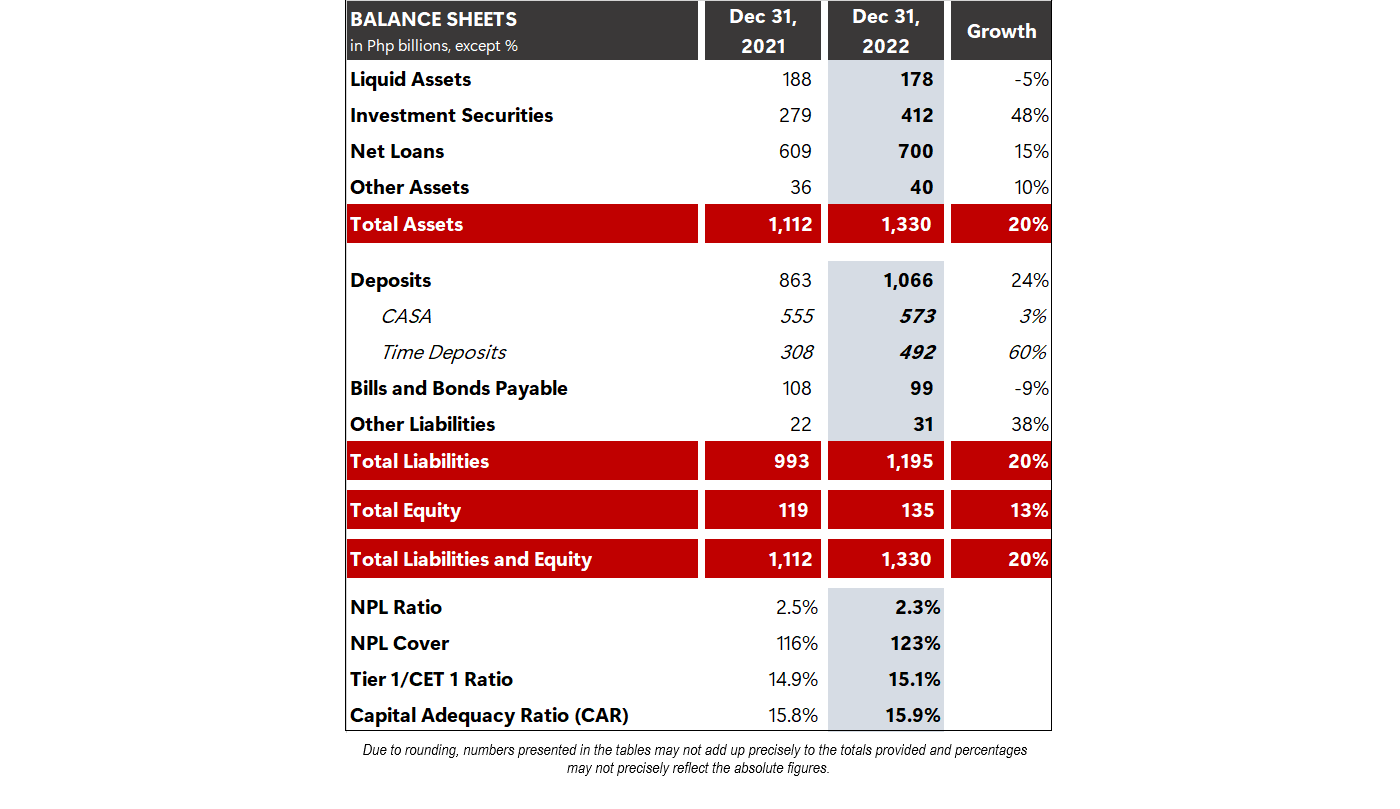

Chinabank remains as the 4th largest privately-owned domestic bank with total assets of P1.3 trillion, up 20%, bolstered by robust earning assets and deposits expansion.

Net loans rose by 15% to P700 billion on vigorous business and consumer lending to drive economic rebound. Even with this increase, the Bank recorded better-than-industry non-performing loan (NPL) ratio and NPL coverage ratio of 2.3% and 123%, respectively.

Total deposits reached P1.1 trillion, 24% higher on sustained growth across deposit products. Current and savings account (CASA) deposits increased to P573 billion for a CASA ratio of 54%.

Total equity stood at P135 billion, up 13%, with a common equity tier 1 (CET 1) ratio of 15.1% and total capital adequacy ratio (CAR) of 15.9%.

“Chinabank continues to be strong and profitable, with ample liquidity and capitalization to achieve our ambitious goals, and more importantly, to deliver long-term, sustainable value to our stakeholders,” said Chinabank Chief Finance Officer Patrick D. Cheng.

Chief Operating Officer and incoming Chinabank President & CEO Romeo D. Uyan Jr. is excited about the possibilities ahead for the bank. “These results were made possible by the hard work and dedication of our employees. Our investments over the past years have started to bear fruit as evidenced by the record growth in assets and profits that we have been reporting. We also will keep on investing in our people and capabilities as Chinabank continues to play an increasing role as one of the preeminent institutions in the Philippine banking industry.”

The Bank’s strong financial performance is underscored by its good governance practices. Chinabank is among the best-governed publicly listed companies, winning the Five-Golden Arrow Award, the Institute of Corporate Directors’ highest recognition for governance excellence, and the ASEAN Capital Markets Forum’s distinction as an ASEAN asset class and as one of the Top 20 publicly listed companies in ASEAN and one of the Top 3 in the Philippines.