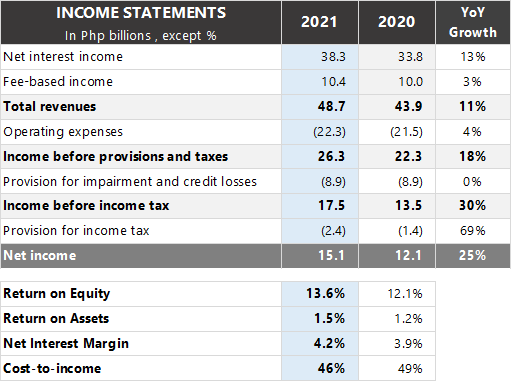

Chinabank posts 25% higher profits in 2021 to P15.1 billion

China Banking Corporation (Chinabank, PSE symbol: CHIB) ended 2021 stronger than ever before on the back of sustained core business growth and effective cost management. The Bank posted a 25% increase in net income to P15.1 billion, which translated to an improved return on equity and return on assets of 13.6% and 1.5%, respectively.

Due to rounding, numbers presented in the tables may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Chinabank continued to prudently manage interest expense, which dropped 44%, resulting in a net interest income of P38.3 billion, up 13%, and better net interest margin of 4.2%. Meanwhile, credit provisioning was steady at P8.9 billion.

Fee-based income grew 3% to P10.4 billion, underpinned by a 39% increase in core fee-based income such as foreign exchange gain, trust revenues, investment banking commissions, sale of acquired assets, bancassurance fees, and other transaction-based service charges.

The growth in operating expenses was controlled at 4% to P22.3 billion. The sustained efforts to manage expenses while investing in growth strategies resulted in a better cost-to-income ratio of 46% from 49%.

“Our 2021 results reflect our disciplined execution of strategies and commitment to supporting our customers and employees. As we increasingly automate and digitize to navigate the continuing challenges of this pandemic, we are focusing on actions and investments that will redound to superior banking experiences and improved financial outcomes,” said Chinabank President William C. Whang.

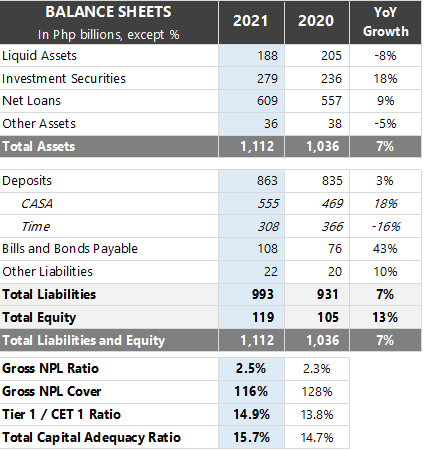

Chinabank closed 2021 with P1.1 trillion in assets, up 7%, supported by a 9% expansion in loans. Meanwhile, deposits increased 3% to P863 billion which was driven by an 18% build-up in checking and savings accounts (CASA) deposits.

Due to rounding, numbers presented in the tables may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

“We deployed more loans to businesses to aid their recovery while continuing to support the credit needs of consumers. We kept a close eye on asset quality, maintaining a lower-than-industry non-performing loans ratio of 2.5% and adequate NPL coverage of 116%,” said Chinabank Chief Finance Officer Patrick D. Cheng. “We sustained a robust CASA growth, further improving our CASA ratio to 64% from 56%,” he added.

Total equity increased 13% to P119 billion, with a common equity tier 1 (CET1) ratio of 14.9% and total capital adequacy ratio (CAR) of 15.7%, well above the regulatory minimum requirement.

International finance journal The Asset recognized Chinabank as the Best Bank in the Philippines in 2021, affirming its strong financial performance and even besting the largest banks in the country. The Bank's investment house, Chinabank Capital, was also named as the Best Bond Adviser (Domestic) for the sixth consecutive year.

Chinabank also emerged as the second strongest bank in the Philippines and among the top 20% in the Asia Pacific region in The Asian Banker’s ranking of 500 strongest banks in 2021. It made the biggest leap among the nine Philippine banks included in the prestigious list, jumping from 323rd place in 2020 to 81st place last year.

Moody's Investors Service affirmed Chinabank’s investment grade credit rating with a stable outlook, citing its improved capital and profitability to mitigate risks to asset quality. Philippine Rating Services Corporation (PhilRatings) also maintained the Bank’s PRS Aaa (corp.) rating with a stable outlook, the local debt watcher’s highest credit rating, on account of its established track record and resiliency, sound funding profile, lower interest expense, more-than-satisfactory asset quality, and ample capital buffer.