Chinabank posts 9-month net income of P11.2B, up 35%

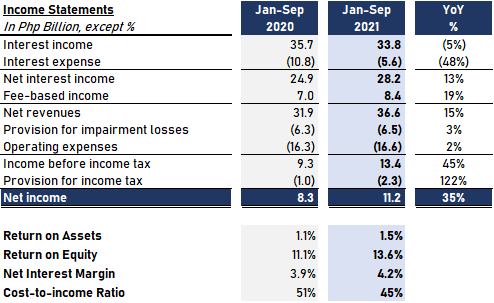

China Banking Corporation (Chinabank, PSE stock symbol CHIB) posted a consolidated net income of P11.2 billion for the January to September period, 35% higher compared to the same period last year on the back of sustained core business growth and effective cost management.

The Bank was able to ride out the economic headwinds, recording quarterly income growth since the start of the COVID-19 pandemic. In the third quarter alone, Chinabank saw its net earnings grow 29% to P3.9 billion versus 3Q 2020.

The strong performance in the first nine months of 2021 translated to a higher return on equity of 13.6% and an improved return on assets of 1.5%.

Net interest income rose 13% to P28.2 billion as interest expense dropped by 48% with the growing share of customer deposits in current and savings accounts (CASA). Net interest margin improved to 4.2%.

Due to rounding, numbers presented in the tables may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Credit provisions of P6.5 billion were relatively flat versus last year.

Meanwhile, fee-based income grew 19% to P8.4 billion, underpinned by a 40% uptick in core fee-based earnings to P4.4 billion from service charges, fees and commissions, forex gains, income from acquired assets, trust, and bancassurance operations.

Operating expenses slightly increased mainly from overhead costs, but the Bank continued to improve its cost efficiency, recording a better cost-to-income ratio of 45%.

“These results exceeded our expectations,” said Chinabank President William C. Whang. “We will continue to support our customers, especially those who are still struggling amid the global pandemic, as we push for greater efficiencies and sustainable growth through digitalization and optimization of our branch and ATM networks.”

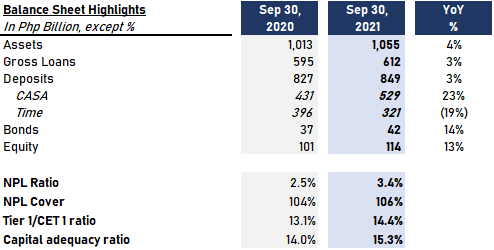

Chinabank maintained its balance sheet strength, with P1.0 trillion in assets, up 4%.

With the gradual return of business activities, gross loans expanded 3% to P612 billion. Gross non-performing loan (NPL) ratio was at 3.4%, lower compared with the Bank’s June level and the industry average for the period. The higher credit buffers resulted in an NPL cover of 106%.

On the funding side, total deposits rose 3% to P849 billion, underpinned by a 23% increase in CASA.

“Chinabank’s sustainable funding sources and strong capital continue to be key strengths. About 62% of the Bank’s P849 billion total deposits were accounted for by CASA, up from 52% last year, and this helped bring down our overall funding cost. Our healthy capital ratios also reflect the Bank’s financial soundness,” said Chinabank Chief Finance Officer Patrick. D. Cheng.

Total capital funds stood at P114 billion, up 13%, for a common equity tier 1 (CET1) ratio of 14.4% and a total capital adequacy ratio (CAR) of 15.3%.

The 101-year-old bank was recently named as one of the strongest banks in 2021 in terms of balance sheet by The Asian Banker. The financial magazine ranked Chinabank as the 2nd strongest bank in the Philippines—ahead of the two other biggest banks in the country—and in the top 20% of the 500 strongest banks in the Asia Pacific region.

The Asian Banker evaluated banks' balance sheet strength based on their 2020 results. Chinabank was cited for registering the lowest gross NPL ratio among Philippine banks included in the Asian Banker 500, at 2.3% as of December 2020, and for its improved profitability, cost-to-income ratio, and return on assets, and robust capital and liquidity positions amid a difficult year.

The recognition came on the heels of validations from rating agencies of the Bank’s financial stability and credit worthiness. Moody’s Investors Service affirmed the Bank’s investment grade credit rating of Baa2 in September, and Philippine Rating Services Corporation (PhilRatings) gave the Bank the highest credit rating of PRS Aaa (corp.) in October. Both credit ratings carry a stable outlook.

Chinabank’s financial strength is supported by its governance excellence. Earlier this year, The ASEAN Capital Markets Forum distinguished it as among the top 3 publicly-listed companies in the Philippines and among the top 20 in ASEAN, and as an ASEAN Asset Class. The Institute of Corporate Directors awarded the Bank with the highest recognition, the Four Golden Arrow. Meanwhile, in acknowledgment of the Bank’s strong support for its initiatives to build an inclusive and increasingly digital Philippine economy, the Bangko Sentral ng Pilipinas named Chinabank as an outstanding stakeholder.