eBanking Security Advisory

Protect yourself from scammers and fraudsters.

Chinabank Mobile App Security Features

AUTOMATIC TIME OUT

To reduce the risk of unauthorized access to your account, our system will automatically log you out from your session after a period of inactivity.

OAC & OTP

A One-time Activation Code (OAC) will be sent to your registered email address for your initial login. For your subsequent logins, a One-time Password (OTP) will be sent to your registered mobile number to authenticate your financial transactions.

ALERTS

We automatically generate SMS or email alerts to notify you each time a successful transaction is performed.

Chinabank Online Security Features

ENCRYPTION

Chinabank Online implements TLS (Transport Layer Security) encryption technology that will protect your confidential information. You are using encryption if the website address begins with https:// and you see a closed padlock beside the URL in the address bar.

FIREWALL & INTRUSION PREVENTION SYSTEMS

We put in place security controls that are consistent with industry best practices to protect our online banking infrastructure. Among these controls are state of the art firewalls, intrusion prevention systems and other security technology that aims to safeguard against potential malicious activities.

TRANSACTION AUTHENTICATION

For your online financial transactions to proceed, you are required to enter our nominate ID and your transaction password which is different from your login password. This is for your added protection since every financial transaction is being duly authenticated and authorized. For your Auto-Credit Arrangement (ACA), and Fund Transfer transactions initiated in Chinabank Online Corporate to proceed, you will be required to enter the system-generated One-Time Password (OTP).

AUTOMATIC TIME OUT

To reduce the risk of unauthorized access to your account, our system will automatically log your out from your session after a period of inactivity.

SECURE LOGIN

Chinabank Online requires you to create a strong password. For Chinabank Online Corporate, aside from your company’s Corporate ID, your nominated user ID and password, we require you to enter the One-Time Password (OTP) to complete the login process

ENROLLMENT OF 3RD PARTY ACCOUNTS IN CHINABANK ONLINE CORPORATE

To ensure that funds are transferred to the intended recipient, enrollment of the transferee account is required for all types of fund transfer transactions.

The Chinabank Mobile App has policies and procedures in place to help prevent the misuse of data and to reduce the risk of fraud:

- We ensure that only employees who are servicing accounts have access to your data

- We employ segregation of duties for certain high value transactions

PRACTICE AND SECURITY ASSESSMENT

We regularly conduct extensive vulnerability assessment, penetration testing and attack simulations on our critical systems to proactively find and remediate vulnerabilities.

- Independent ethical hacking reviews conducted by outside security firms

- Ongoing scanning and monitoring to protect against known security risks

- Application vulnerability assessments

- Internal security assessments and use of technology to monitor and maintain a safe and stable environment

- Regular mandatory security training of employees

Be Aware

The best way to protect yourself against social engineering is to always be AWARE:

Ask yourself first before you post anything on social networking sites – birthdays, addresses, contact numbers, family, job, schedules, travels, location, affiliations, “likes” or anything that can be used for identity theft, whereabouts tracking or fraud perpetuation.

Watch out for unexpected/ unexplained/ unusual calls or emails. Confirm authenticity of anyone with whom you communicate – get contact number from your card, statement, etc. and be wary of the information you share.

Always check your privacy settings on social networking sites.

Refrain from clicking on links embedded in emails and be particularly conscious of embedded links, emails or text messages that ask for password verification.

Ensure that your personal information are disclosed only to those whom you intend to share it with – people or organizations that legitimately require these information.

Fraud Response

Chinabank will never ask for your personal information such as birth date, account number, credit card number, CVV, ATM PIN, and One-Time Password (OTP) through call, text, or email.

If you receive any suspicious calls, texts or emails, kindly report immediately to our Customer Contact Center at (632) 888-55-888 or email us at online@chinabank.ph.

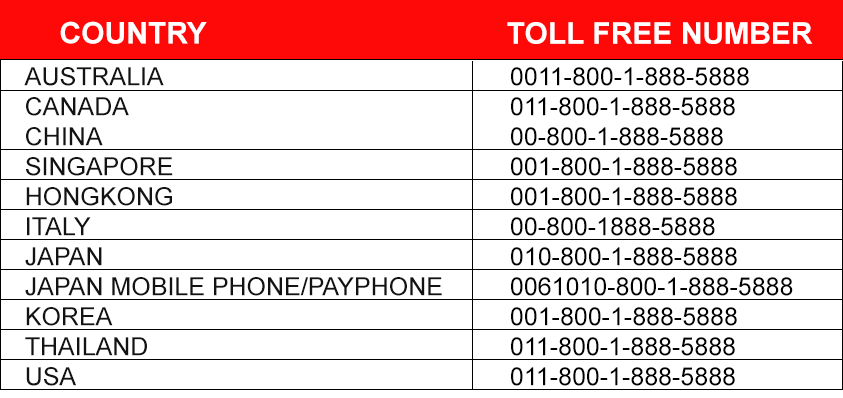

For customers outside the Philippines, you may dial our international toll-free numbers.