On its 105th year, Chinabank affirms customer focus with new offerings

Chinabank is celebrating its 105th anniversary, ever focused on the people and communities it serves. The country's fourth largest private universal bank continues to improve and expand its offerings, demonstrating its passion for innovation and commitment to its customers.

The bank launched the best iteration of its mobile app so far. With a user-friendly design, improved security, and intelligent features like mobile check deposit, seamless account management, and online account opening, My CBC makes saving, paying, and moving funds easy and worry-free.

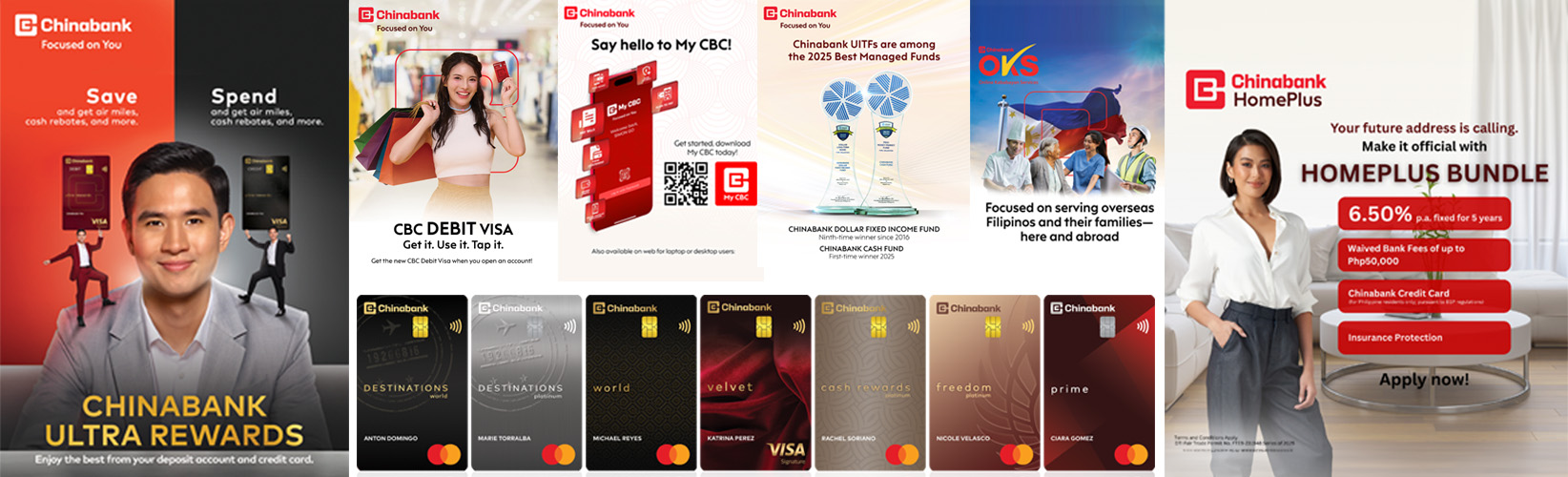

New depositors enjoy the convenience of cashless shopping at millions of stores and online merchants worldwide with CBC Debit Visa and CBC Debit Visa Signature. These debit cards are also accepted at ATMs locally and abroad for easy cash withdrawal and provide exclusive discounts and privileges through CBC Deals and at select Visa partner establishments.

With Chinabank Ultra Rewards, an innovative program that combines a high-earning deposit account with a versatile credit card, customers get ultra rewarded for saving and spending. They earn rewards points for deposits on top of the regular deposit account interest, plus rewards points for using the Ultra Rewards Credit Card.

For more spending power, rewards, and exclusive deals, Chinabank now offers nine credit card variants with various rewards and benefits to fit every lifestyle. And with its pioneering 30-minute card issuance process, customers can get the CBC Credit Card of their choice in no time.

Chinabank makes buying or building a home more affordable with its HomePlus Bundle— low interest rate of 6.5% p.a. fixed for five years and waived bank fees. This special offer is for new home loan applications received until November 30, 2025 and booked until December 31, 2025.

For investors, the bank now offers 12 unit investment trust funds (UITF), catering to varying risk appetites and investment horizons. These include two UITFs recognized this year by the CFA Society Philippines for delivering superior returns to investors: Chinabank Dollar Fixed Income Fund, Best Managed Fund in the Long-Term Bond category for the 9th time, and Chinabank Cash Fund, Best Managed Fund in the Money Market Fund category.

For Filipinos everywhere, Chinabank is continuously expanding its global remittance network to make sending money home easy, fast, and safe. And for their loved ones, the bank offers OKS Peso Savings and OKS US Dollar Savings accounts. These very affordable accounts—no minimum initial deposit for OKS Peso Savings, while only $10 for OKS US Dollar Savings—provide access to all of the bank’s services, from digital banking to loans and investment products.