Chinabank Credit Cards

Transaction Conversion Program

No need to worry when going on a shopping frenzy. Convert your straight transactions and major purchases into light and easy installment payments.

How to Apply for Transaction Conversion

- Download and fill out the Transaction Conversion Application Form and send it via e-mail to document_creditcards@chinabank.ph.

- Call Chinabank's Customer Service Hotline at +632 888-55-888 or Domestic Toll-Free Number 1-800-1888-5888 (PLDT) and request for Transaction Conversion.

Transaction Conversion Terms and Conditions

1. The Transaction Conversion Program is open to all active principal Chinabank Credit cardholders* in good credit standing.

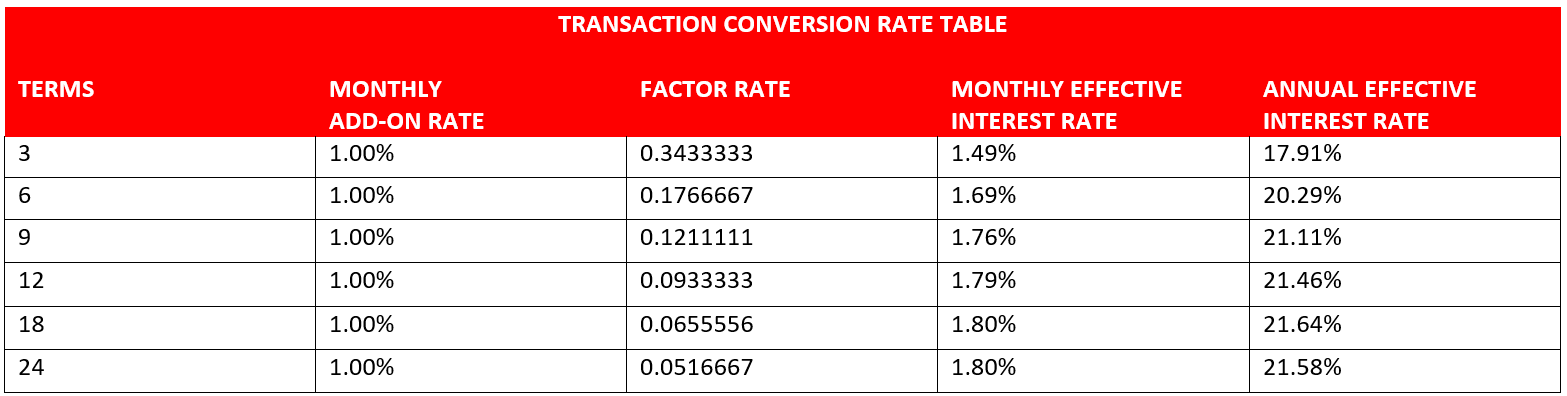

2. The Transaction Conversion Program is available for 3, 6, 9, 12, 18 and 24-month terms with the following rates:

3. A minimum Transaction Conversion amount of PHP3,000.00 is required for this program. Cardholders may combine transactions to reach the required minimum amount.

4. Computed interest should be within the available credit limit.

5. Application for Transaction Conversion must be received by Chinabank at least ten (10) banking days before the due date of the latest Statement of Account (SOA) reflecting the transaction/s being applied for conversion to installment.

6. To apply, cardholder shall either –

a. Fill out the Application for Credit Card Transaction Conversion Form and send via email to document_creditcards@chinabank.ph; or

b. Call the Chinabank Customer Service 24/7 Hotline at +632 888-55-888 or Domestic Toll-Free Number 1-800-1888-5888 (PLDT), and request for Transaction Conversion.

7. Only straight retail transactions posted within the last thirty (30) days at point of application are qualified for the program. Transactions that have formed part of the cardholder’s revolving balance are no longer eligible for conversion.

8. The card should be activated, current, not past due or delinquent. All over limit, past due, and accounts with collection issues are not eligible for transaction conversion.

9. Quasi-cash transactions, service merchant transactions (gasoline, supermarket and drugstores), installment transactions (Merchant Installment, Balance Transfer, Convert-to-Cash, Balance Conversion, and Transaction Conversion), utilities (electricity, phone/mobile, etc.), ATM transactions (Cash Advance, payments, etc.), Fees and Charges and Pre-terminated installment transactions are excluded from the program.

10. Foreign currency transactions will be converted into PHP using the credit card rate of the day when the Transaction Conversion application was processed.

11. The amount to be converted to installment must be the entire transaction amount.

12. Approved Transaction Conversion applications shall not earn Reward Points.

13. The Transaction Conversion application shall be subject to appropriate evaluation. Chinabank shall have the absolute and exclusive right to approve or reject the Transaction Conversion request. Chinabank reserves the right to deny the processing of the Transaction Conversion for whatever valid reason and Chinabank has no obligation to disclose the reason to the cardholder.

14. The Transaction Conversion request shall be processed by Chinabank within five (5) business days from the time the complete application was received by Chinabank.

15. The Transaction Conversion’s first monthly amortization will be immediately posted to the cardholder’s Statement of Account (SOA) upon approval of request

16. The approved Transaction Conversion amount shall be posted in equal and successive monthly installment and shall commence on the cardholder's next billing date until the Transaction Conversion balance is paid in full.

17. Failure to pay four (4) consecutive minimum amount dues will cancel the installment transaction and all remaining unpaid monthly installments, total outstanding balance and applicable fees & charges shall immediately become due and demandable.

18. In case of pre-termination or cancellation of the Transaction Conversion, the unpaid remaining total principal amount shall be subject to the prevailing Instalment Pre-termination Fee**, and shall be posted back as a regular straight transaction.

19. The cardholder acknowledges his liability to Chinabank for every approved Transaction Conversion application and shall form part of the cardholder's obligation to Chinabank.

20. Officers of China Banking Corporation are not qualified to avail of the Transaction Conversion Installment facility.

21. Terms and Conditions governing the issuance and use of Chinabank Credit Cards are incorporated herein by reference and made integral hereof.

*Cardholders in good credit standing are those whose accounts are active and current and not blocked, delinquent or past due, not under any collections repayment program or special installment, non-investigation due to suspected fraudulent activities, or those whose Credit Cards are not reported lost or stolen, and those who have not otherwise, violated any of the Terms and Conditions governing Chinabank Credit Cards.