Sustainability at Chinabank

Chinabank's Sustainability Strategy is to support its vision and mission through responsible Value Creation activities that Contribute to the environment and society, while being Resilient.

In doing so, we operate under conditions that are Viable to the company and the community. We will ensure that our contributions are Equitable to the environment and society, and that risks are Manageable.

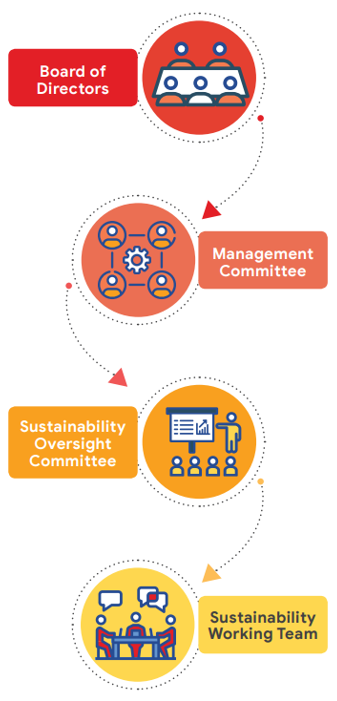

It shall be governed by its Corporate Governance and Risk Management framework.

|

Our Approach Recognizing Chinabank's vital role in advancing sustainable development - not just by being responsible in managing the impact of our operations, but also in making responsible decisions in lending, investing, and the services we offer - we have been progressively integrating sustainability principles on three fonts: through value creation, through our contribution, and by being resilient. |