HomePlus Bundle Promo Mechanics

PROMO MECHANICS

I. Qualifications

The Chinabank HomePlus Bundle Promo (the “Promo”) is open to all clients with newly approved HomePlus Loans during the Promo Period (the “HomePlus Loan”), subject to the terms and conditions below.

II. Program Details

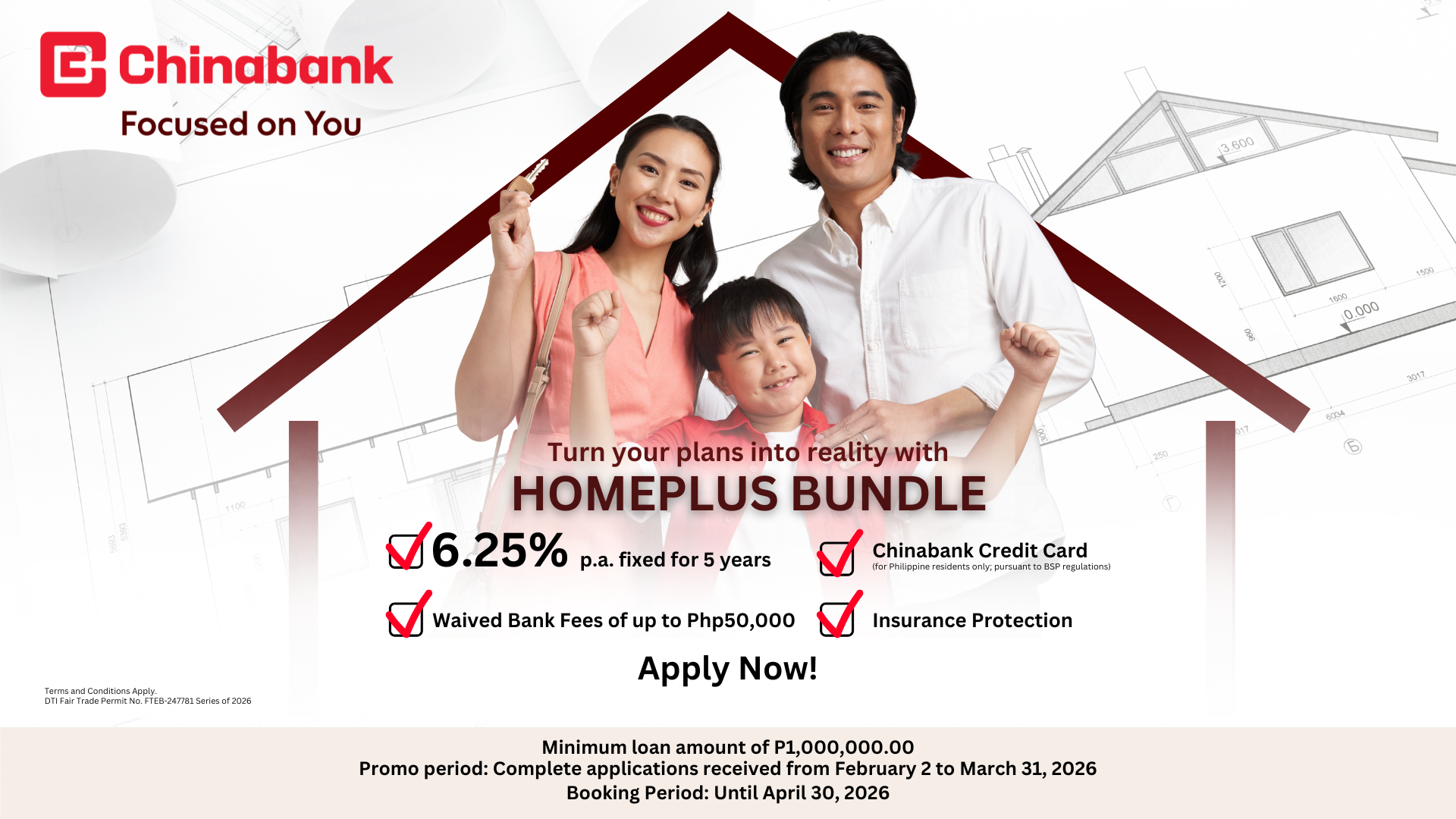

1. HomePlus Loan clients with a minimum loan amount of PHP 1,000,000.00 may be entitled to a special interest rate of 6.25% per annum fixed for five (5) years on their HomePlus Loan and waiver of applicable bank fees and charges up to PHP 50,000.00 only, provided that they avail all of the following products and services as a bundle:

- Chinabank Credit Card (applicable to Philippine residents only)

- Mortgage Redemption Insurance (“MRI”) through Chinabank Insurance Brokers, Inc. (CIBI); and

- Property Insurance through CIBI (“Property Insurance”)

(the HomePlus Loan and the above collectively, the “HomePlus Bundle”)

2. Promo Period - All applications for HomePlus Bundle with complete requirements received from February 2, 2026 to March 31, 2026.

3. Disbursement / Booking Period - All HomePlus Bundle applications received during the Promo Period must be subsequently booked until April 30, 2026.

III. Terms and Conditions

1. To qualify for the Promo, the HomePlus Bundle applicant must meet the following conditions:

- The Borrower/Co-Borrower(s) must be both a Filipino citizen and a Philippine resident during the Promo Period and the Disbursement/Booking Period. [1]

- The Borrower/Co-Borrower(s) must submit to Chinabank complete application requirements within the Promo Period and complete post-approval requirements within the Booking/Disbursement Period. In all cases, the HomePlus Loan must be disbursed no later than April 30, 2026.

- The purpose of the HomePlus Loan must be any of the following:

- Acquisition of residential house and lot, townhouse, or condominium unit (with or without parking slot);

- Refinancing or loan take-out of residential property from other banks or financial institutions; or

- Reimbursement (for newly purchased residential property within one [1] year)

2. The HomePlus Loan and Chinabank Credit Card applications shall be evaluated based on Chinabank’s existing credit policies and standards.

3. The HomePlus Loan shall have a minimum loan term of five (5) years.

4. Upon fulfillment of the terms and conditions of the Promo, the special interest rate of 6.25% per annum fixed for five (5) years will be applied on the HomePlus Loan at the time of loan disbursement. Thereafter, the HomePlus Loan interest rate shall be subject to review at the prevailing market rate as of the time of loan repricing.

5. Subject to internal Bank policies, the Chinabank Credit Card shall be separate and distinct from any Chinabank-issued credit card that the client may have at the time of application. The Borrower / Co-Borrower(s) shall be the principal cardholder, and shall not be a supplementary cardholder or a secured cardholder.

6. Maximum amount of bank fees and charges to be waived will depend on actual cost, but not to exceed PHP 50,000.00. The waiver of bank fees and charges* shall only cover the following:

a. Processing Fees;

b. Miscellaneous Fees;

c. Notarial Fees; and

d. Mortgage Registration Fees

and shall apply only once per duly accepted and approved HomePlus Loan collateral. Once the HomePlus Loan is approved, no subsequent substitution or change in collateral shall be permitted for the purpose of qualifying for the Promo.

*Filing fees; documentary stamp taxes on the relevant real estate mortgage agreements and promissory notes; insurance premiums on the MRI and Property Insurance; and other loan-related fees are not included and should be paid separately by the Borrower/s.

7. This Promo is not applicable to the following:

a. New HomePlus loan to refinance or pay-off any existing HomePlus loan with Chinabank; and/or

b. Borrowers with past due account status for any of the following consumer banking products: HomePlus Loan, AutoPlus Loan, or Chinabank Credit Card.

8. All post-approval documents and requirements must be complied prior to loan disbursement to be eligible to avail the Promo.

9. HomePlus Loans availed under this Promo are subject to a lock-in period of sixty (60) months or five (5) years from the date of loan disbursement. In case of Borrower’s partial or full payment of the HomePlus Loan during the lock-in period, Chinabank shall pro-rate the waived bank fees and charge the Borrower’s loan account accordingly.

10. If the Borrower is found to be in violation of any of the terms of the Promo within the lock-in period, the Borrower shall fully and completely reimburse the Bank for all waived bank fees and charges.

11. This Promo is non-transferrable and cannot be exchanged for cash or other items, or used in conjunction with other promotions, discounts or other special considerations, unless otherwise specified in the Promo mechanics.

12. Standard Terms and Conditions of the Chinabank HomePlus Loan, Chinabank Credit Card, MRI, and Property Insurance shall apply.

13. In case of any dispute related to the Promo, Chinabank's decision, in concurrence with the DTI, will be deemed final and non-negotiable.

14. By participating in the Chinabank HomePlus Bundle Promo, the Borrower/Co-Borrower(s) confirms that he/she has read, understood, and agreed to be bound by the foregoing Promo mechanics.

15. For any concerns, inquiries, and requests in relation to this Promo, Borrowers may use the contact channels provided below. Upon receipt thereof, China Bank shall then conduct a comprehensive investigation in accordance with its established procedures and Borrowers shall be notified of its findings, if applicable, which findings shall be final and conclusive.

|

CHINA BANK 24/7 CUSTOMER SUPPORT |

||

|

Customer Contact Center |

China Bank Building, 8745 Paseo de Roxas corner Villar Street, Makati City 1226 Philippines |

|

|

24/7 Hotline |

(+632) 888-55-888 |

|

|

Toll Free (Press “0” to speak to a Phone Banker) |

· Domestic: 1800-1888-5-888 (PLDT) |

· USA / Canada: 011-800-1-888-5888 |

|

· Hong Kong / Singapore / Korea / Thailand: 001-800-1-888-5888 |

· Australia: 0011-800-1-888-5888 |

|

|

· Italy / China: 00-800-1-888-5888 |

·Japan: 010-800-1-888-5888 |

|

|

E-mail Address |

||

|

|

||

|

Twitter (X) |

||

Per DTI Fair Trade Permit No. FTEB-247781 Series of 2026

[1] Chinabank Credit Cards are applicable for Philippine residents only. Clients may be eligible for the Promo even without a Chinabank Credit Card if, at the time of the Promo Period and the Booking/Disbursement Period, the Borrower is an Overseas Filipino and does not have a Co-Borrower who is a Philippine resident. For purposes of this Promo, an Overseas Filipino refers to a person who is living and/or working outside the Philippines.