TERMS AND CONDITIONS GOVERNING CHINA BANK CREDIT CARD’S CASH ADVANCE FACILITY

CASH ADVANCE

The Cash Advance Facility of Chinabank allows eligible Chinabank Credit Card holders (“Cardholders”) to withdraw in cash a portion of their available credit limit from any automated teller machine (ATM).

TERMS AND CONDITIONS

The use of Chinabank's Cash Advance Facility is regulated by the following Terms and Conditions, in addition to the Terms and Conditions Governing the Issuance and Use of Chinabank Credit Cards, and other applicable Chinabank Terms and Conditions.

1. ELIGIBILITY. The Cash Advance Facility is open to Cardholders in good credit standing with active and current accounts. Cardholders must not have accounts that are blocked, delinquent, or past due; enrolled in any collections repayment program or special installment arrangement; under investigation for suspected fraudulent activity; or reported their Credit Card as lost or stolen. Additionally, Cardholders must not be in violation of any of the Terms and Conditions Governing the Issuance and Use of Chinabank Credit Cards.

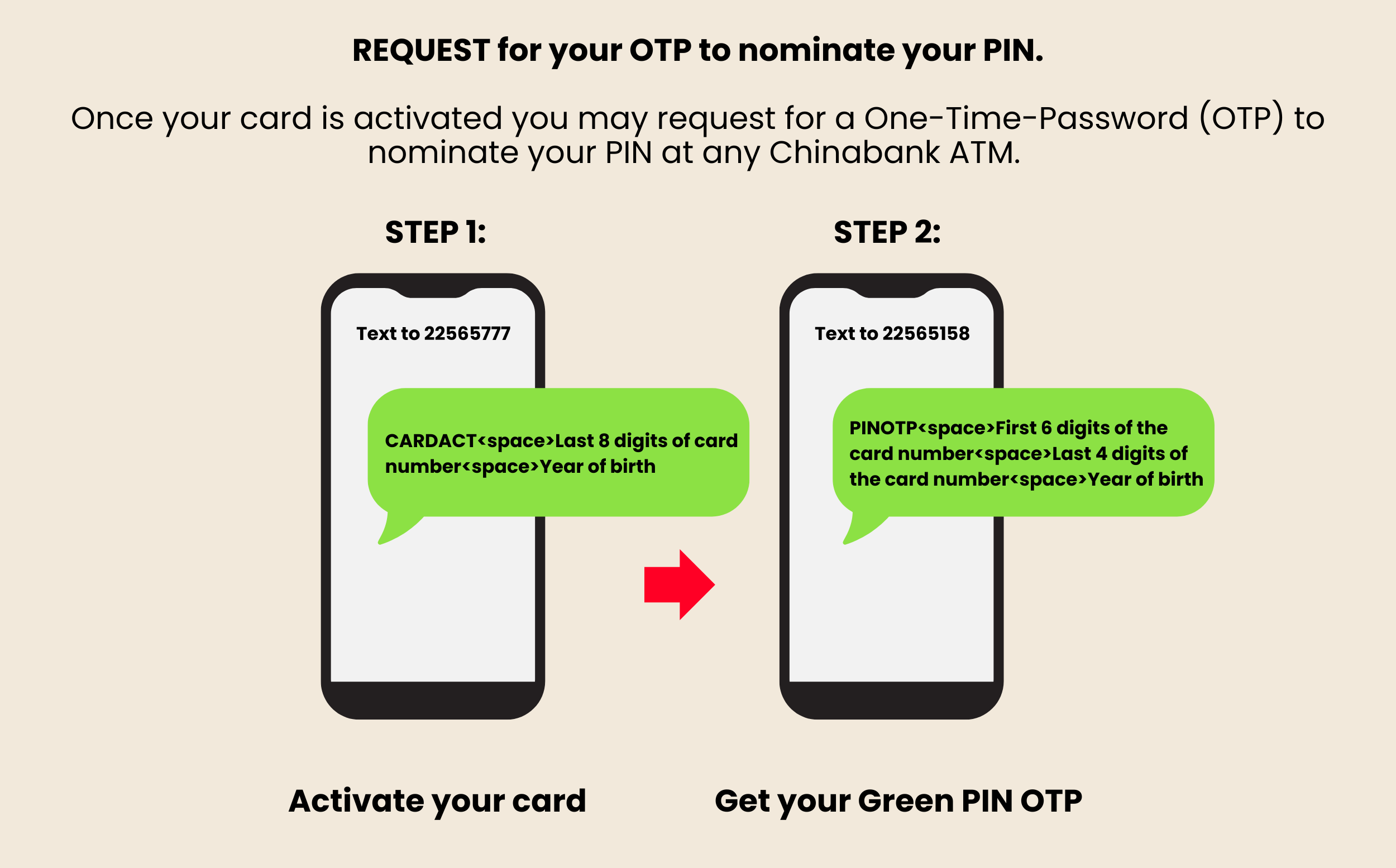

2. CARD ACTIVATION. The Cardholder shall be required to activate their Chinabank Credit Card prior to the issuance of the Personal Identification Number (PIN) for the Cash Advance Facility. By activating the Credit Card, the Cardholder signifies their agreement to be bound by the Terms and Conditions Governing the Issance Issuance and Use of Chinabank Credit Cards and other applicable Chinabank Terms and Conditions.

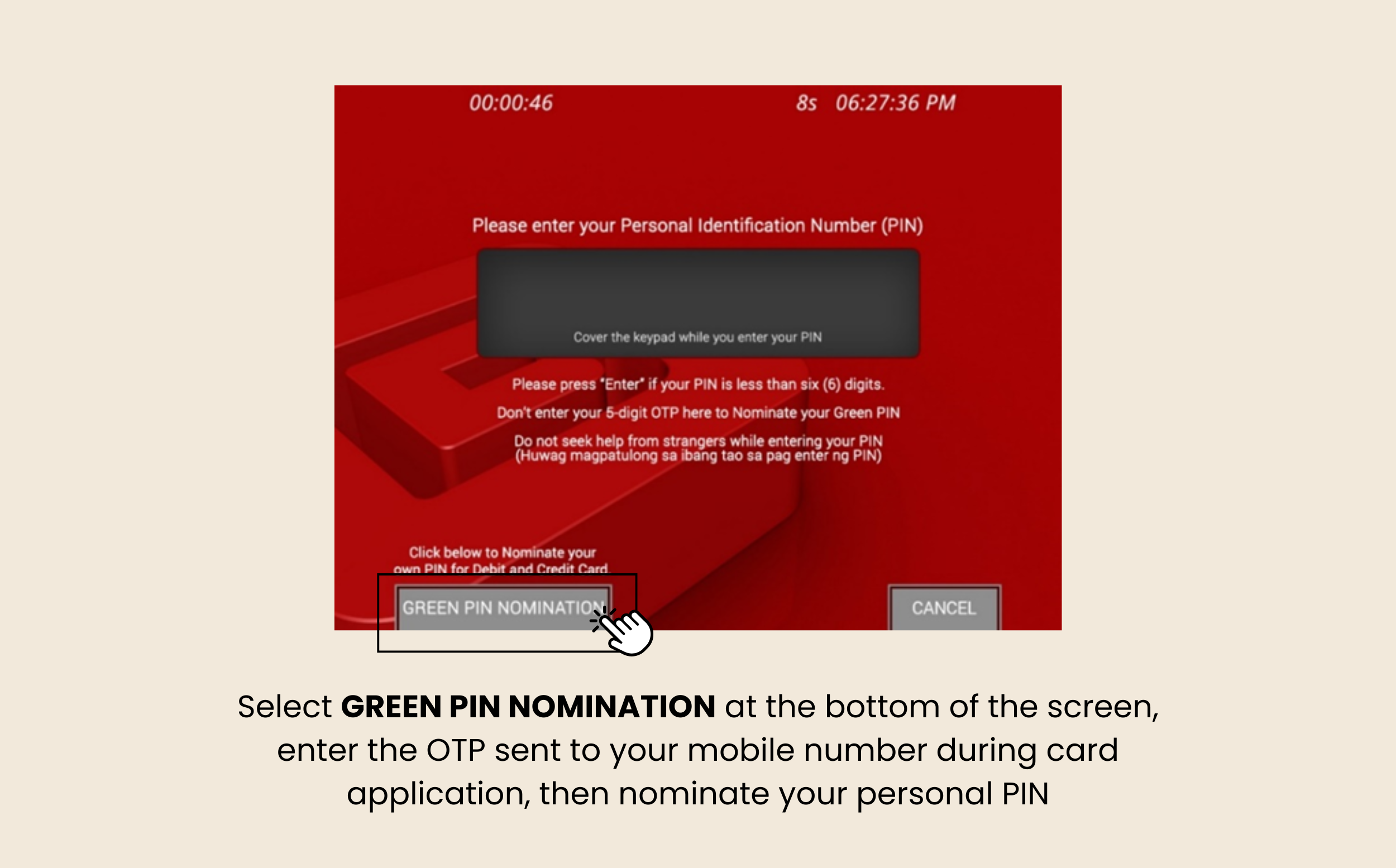

3. CASH ADVANCE PIN. Upon request, the Cardholder shall receive a One-Time Password (OTP) via SMS, which shall be used to nominate their PIN through any Chinabank ATM. By requesting a Cash Advance PIN, the Cardholder agrees to be bound by the Terms and Conditions Governing the Cash Advance Facility.

The PIN is strictly confidential and must not be shared with anyone under any circumstances. If the Cardholder believes that the PIN’s confidentiality has been compromised, they must promptly inform Chinabank and request a PIN change. The Cardholder is fully responsible and liable for all transactions made using the PIN before Chinabank is informed of the potential compromise.

4. CASH ADVANCE LIMIT. The Cardholder may access Cash Advances up to the limit which shall be equivalent to the lower of the (i) remaining amount of Credit Limit (minus current availments and transactions) or (ii) the maximum percentage specified under the specific Credit Card product.

5. CREDIT LIMIT USAGE. Successful Cash Advance availments shall be included in calculating the total Credit Limit used by the Cardholder.

6. APPLICATION OF PARTIAL PAYMENT. In case of partial payment of the Credit Card balances, the same shall be applied to the Credit Card Account in the following order:

For all Chinabank Peso Credit Card Types:

a. Retail Interest billed;

b. Cash Advance Interest billed;

c. Cash Advance Service Charge billed;

d. Annual Membership Fee billed;

e. Late Payment Penalty Charge and other applicable fees billed;

f. Retail Service Charge billed (including installments);

g. Cash Advance Balance billed;

h. Retail Balance billed;

i. Unbilled Retail Interest Charge;

j. Unbilled Cash Advance Interest;

k. Unbilled Cash Advance Service Charge;

l. Unbilled Annual Membership Fee;

m. Unbilled Late Payment Penalty Charge and other applicable fees;

n. Unbilled Retail Service Charge (including installments);

o. Unbilled Cash Advance Balance;

p. Unbilled Retail Balance.

For Chinabank Destinations World Dollar:

a. Cash Advance Interest billed;

b. Retail Interest billed;

c. Cash Advance Service Charge billed;

d. Retail Service Charge billed (including installments);

e. Annual Membership Fee billed;

f. Late Payment Penalty Charge and other applicable fees billed;

g. Cash Advance Balance billed;

h. Retail Balance billed;

i. Unbilled Cash Advance Interest;

j. Unbilled Retail Interest;

k. Unbilled Cash Advance Service Charge;

l. Unbilled Retail Service Charge (including installments);

m. Unbilled Annual Membership Fee;

n. Unbilled Late Payment Penalty Charge and other applicable fees;

o. Unbilled Cash Advance Balance;

p. Unbilled Retail Balance.

7. FEES AND CHARGES. Cash Advance transactions are subject to applicable service fees and finance charges.

7.1 Cash Advance Fee. Each Cash Advance transaction shall incur a fixed fee of ₱200 or USD3.50. Withdrawals from non-Chinabank ATMs are also

subject to additional fees imposed by the acquiring bank, which can vary. The ₱200 or USD3.50 Cash Advance fee is separate from any

Acquirer-Based Fees.

7.2 Cash Advance Interest. A 3% interest is charged on the amount withdrawn via Cash Advance through an ATM. Interest accrues daily and

continues to apply until the full amount is settled.

7.3 Other Fees.

7.3.1 ATM Withdrawal Fee. For cash advances transacted through other banks’ ATMs, an ATM Withdrawal Fee will be incurred. As an

Acquirer-Based Fee, this may vary depending on the bank.

7.3.2 Balance Inquiry Fee. A balance inquiry fee is a charge applied when a cardholder checks their account balance at ATMs of other banks.

As an Acquirer-Based Fee, this may vary depending on the bank.

7.3.3 International Withdrawal. Transactions made in foreign currencies and/or with foreign merchants shall be subject to a 2.5% Foreign Transaction

Fee which is comprised of Mastercard/Visa’s Assessment Fee and Foreign Currency Conversion Fee.

8. AVAILABILITY. The Principal Cardholder and/or Supplementary Card Cardholder(s) may, upon full satisfaction of the credit requirements as may be required by Chinabank, avail of Cash Advances through Chinabank and non-Chinabank ATMs.

9. PROHIBITED USE OF INTERNATIONAL CASH ADVANCE ACCESS. The Cardholder agrees and warrants that the proceeds of any Cash Advance availments abroad shall not be used for foreign investments or the payment of foreign loans or in violation of any existing foreign currency exchange rules and regulations.

10. AMENDMENTS. Chinabank may alter, change, or modify these Terms and Conditions with prior notice.

11. EFFECT OF OTHER TERMS AND CONDITIONS. Chinabank’s Terms and Conditions Governing the Issuance and Use of the Card/Credit Card Agreement of the Cardholder with Chinabank shall apply and are incorporated herein by reference. Cash Advance will also be subject to the rules and regulations of the Card Network.

12. GOVERNING LAW. This Agreement is governed by and shall be construed in accordance with Philippine laws.

13. ACCEPTANCE. Any use of a Chinabank Credit Card together with the Cash Advance PIN to obtain cash in any ATM constitutes the Cardholder’s agreement to these Terms and Conditions, to the Terms and Conditions Governing Issuance and Use of Chinabank Credit Cards, and other applicable Chinabank Terms and Conditions.

14. CONSENT TO DISCLOSURE. The Cardholder agrees that Chinabank may share, transfer and disclose details of their Cash Advance transactions to acquiring banks and Credit Card networks for the purpose of debiting the Cash Advance amount from their Credit Card account.

15. CUSTOMER SERVICE. For inquiries or concerns on their Credit Card accounts, Cardholders may contact the Chinabank Customer Service 24/7 Hotline at +632 888-55-888 or e-mail creditcards@chinabank.ph.

Chinabank is regulated by the Bangko Sentral ng Pilipinas (BSP). Details of the BSP’s Consumer Assistance Mechanism are provided in www.bsp.gov.ph/.